5 Signs It’s Time to TRADE UP Your CPA for a Certified Tax Planner

Tax season is the time of the year most business owners value their CPA the most. And while accurate and timely reporting and filing is

Categories

Recent blogs

What Accounting Method Should I Use for My Real Estate Holdings? A Surprising Tax Strategy

When it comes to maximizing your real estate investments, forming a clear tax strategy is a key step. For many taxpayers, the first thing that

What Entity Should I Use for Real Estate Holdings? LLCs vs LPs

For real estate investors, placing your property into a business entity can serve as a great tax savings strategy. This allows you to separate properties

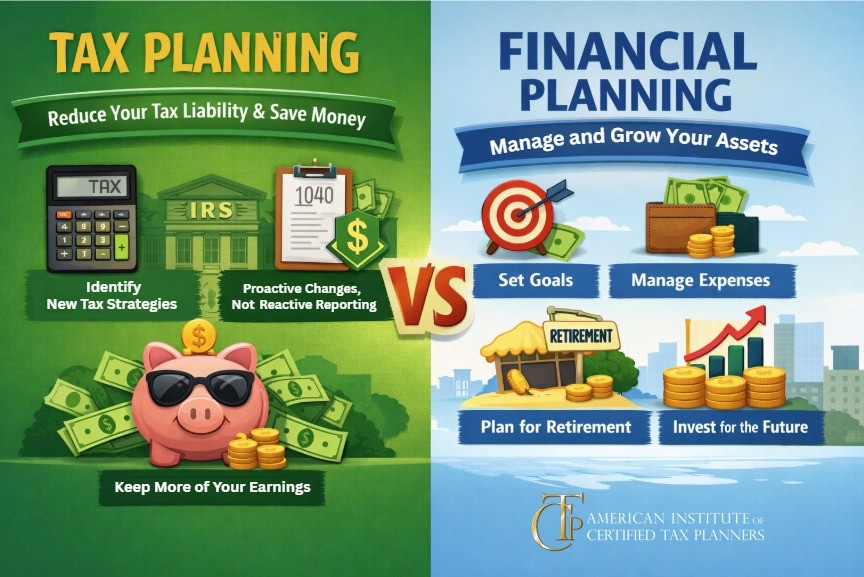

Tax Planning vs. Financial Planning: Why You Need to Understand the Difference

Many business owners assume tax planning is something to think about later – often lumped together with retirement or viewed as a byproduct of financial

Part 3: What’s the Alternative? Unusual Retirement Strategies That Can Save You on Taxes

Traditional retirement savings plans like 401(k)s and IRAs can go a long way in helping you prepare for retirement. However, these account types can also

Part 2: What’s the Alternative? Unusual Retirement Strategies That Can Save You on Taxes

More than half of Americans have a traditional retirement plan like a 401(k) or IRA. For many, these can be straightforward and effective ways to

Part 1: What’s the Alternative? Unusual Retirement Strategies That Can Save You on Taxes

Are all of your retirement “eggs” in one “savings basket”? If you’re part of the 59% of Americans who have a retirement savings plan, chances are

There’s a New Set of SALT Rules in Town: How to Avoid a Tax Increase

How does the “One Big Beautiful Bill” Act (OBBBA) impact you? That’s the question on the minds of many taxpayers—and business owners in particular. Like

Part 3: There’s a New Tax Act in Town: Doubling Down on Deductions

Now that the dust has begun to settle and Americans are wrapping their minds around the many details of the “One Big Beautiful Bill” (OBBB),

Part 2: There’s a New Tax Act in Town: Benefits for Businesses

It’s official: The new tax package referred to as the “One Big Beautiful Bill” (OBBB) has been signed into law, ushering in a new era

Part 1: There’s a New Tax Act in Town: Benefits for Businesses

With the recent passage of President Trump’s “One Big Beautiful Bill” Act (OBBB), many question marks that have been floating in the air since the