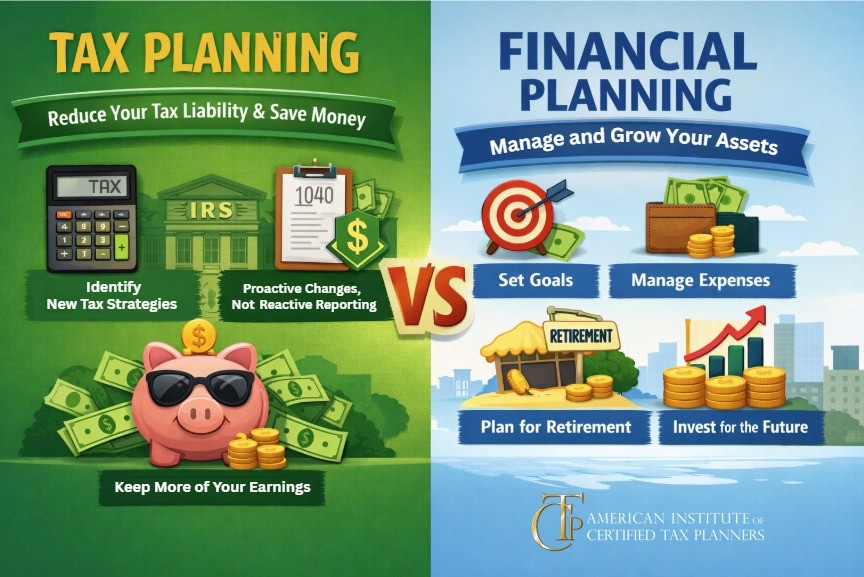

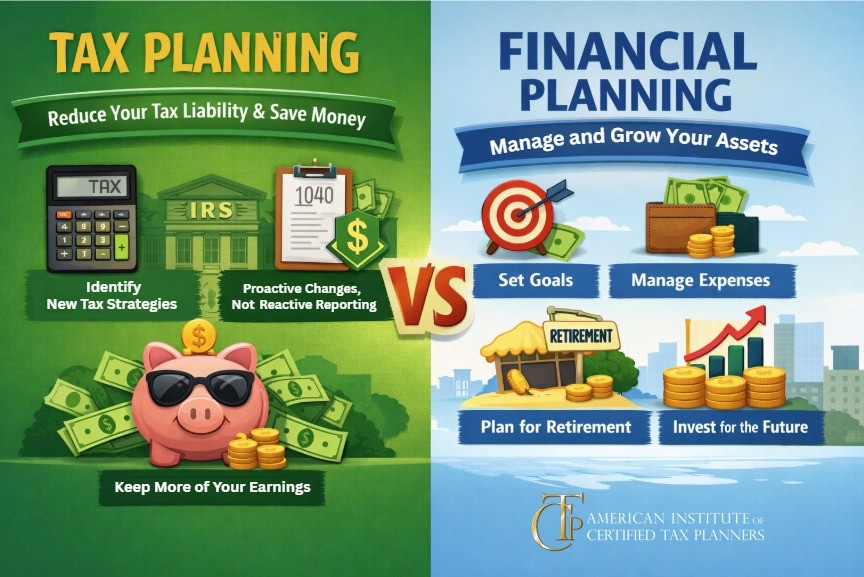

Tax Planning vs. Financial Planning: Why You Need to Understand the Difference

Many business owners assume tax planning is something to think about later – often lumped together with retirement or viewed

Many business owners assume tax planning is something to think about later – often lumped together with retirement or viewed

Sports fans know that team loyalties run deep. Committed supporters of college and even high school sports teams now have

Most student athletes dream of taking home the championship trophy or being drafted onto a professional team. Whether or not

Tax avoidance versus tax evasion: can you name the difference? The distinction is absolutely essential and can mean the difference

Medical expenses can become a financial burden the further along you get in years. AARP estimates that if you are

Rising health care costs are becoming a financial obstacle for many retirees. The Fidelity Retiree Health Care Cost Estimate found

An IRS audit can happen to anyone—but this is not an invitation to panic. With enough advance preparation, you can

Just the mention of the word “audit” can strike fear into a taxpayer’s heart—but with enough preparation, an audit does

Tax audits are, unfortunately, a possibility that every taxpayer should be prepared for. Even if you’ve crossed your t’s and

Investing in a tax plan can feel like a risk for taxpayers who are used to filing their own tax