Tru Tax Planner

The only Tax Planning software that actually PLANS

Tru Tax Planner gives you the tools you need to analyze complex tax planning scenarios, run projections, measure the results of your tax reduction ideas, and develop the optimal combination of strategies to reduce tax.

Accurately estimate tax liabilities including federal income tax, AMT, and captial gains and measure the value of your tax reduction ideas.

AICTP teaches a proprietary process to evaluate every client’s tax situation individually, using our software to help you determine the right combination of strategies for the biggest savings opportunities. While our unique software can act as a helpful tool in your tax planning project, the most important part of the process is the expert education you rely on to guide your actions. This can be uncomfortable for some tax professionals who want to offer tax planning, yet lack the background or education that this expert niche demands.

There is no DIY tax planning software solution that can reliably take the place of education and experience. You see, the IRS doesn’t accept “the software suggested using this amount” as a valid reason when they grill you about which law you’ve relied on for your position.

________

**Read more: Ethical Concerns In Using Tax Planning Software And: Tax Planning Software – Artificial Intelligence or Skill Saw?

As part of our program, Tru Tax Planner offers all you need to find the best combination of tax reducting strategies:

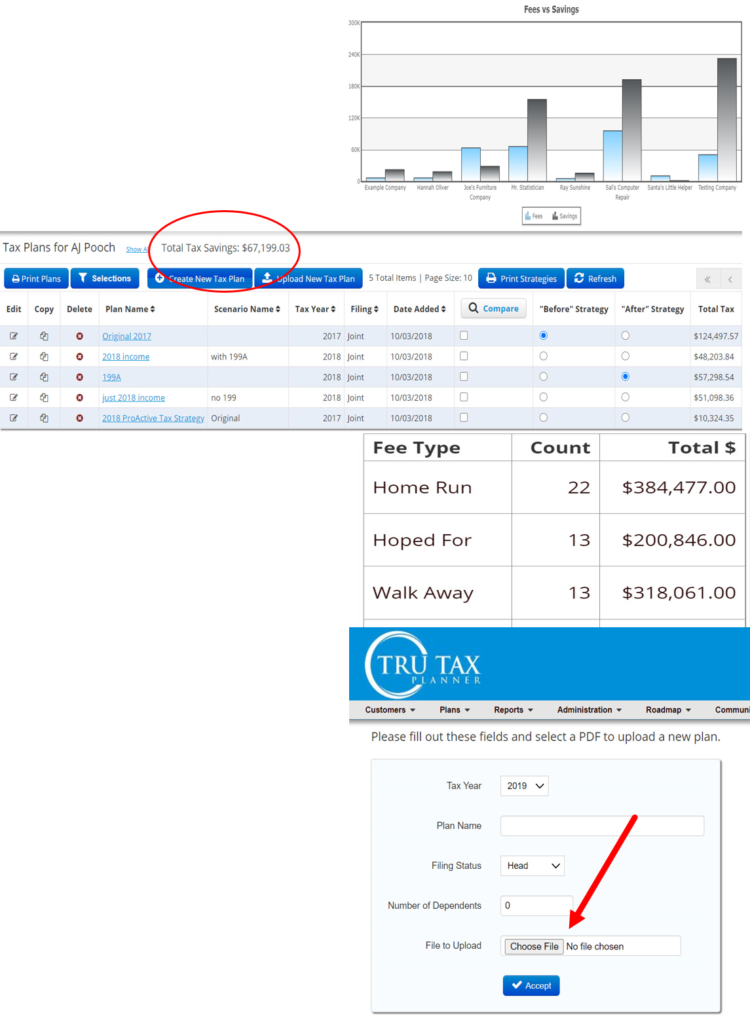

Build side-by-side models to map out the optimal combination of tax reduction tactics.

Then calculate the total tax savings.

Simply follow our step-by-step process:

Upload a pdf of the taxpayer’s most recent return

Answer a few easy questions about their current situation and where they want to go

Review the tax planning roadmap suggesting ways to save money

Use these ideas to estimate savings

Relay estimated tax savings to prospective tax planning client and sell premium fee engagement

Collect payment ($2,500-$1 million per plan)

Run projections, illustrations, and analysis in our side by side comparison tool

Select model with greatest tax savings

Run projections, illustrations, and analysis in our side by side comparison tool

Watch your tax planning profits soar!

Prove Return on Investment (ROI) to your clients with our Fees to Savings Dashboard

Easily calculate total tax savings to the penny with up-to-date calculations and tax law

Track new planning revenues as a Key Performance Indicator for your planning practice

Import most recent tax return by uploading a pdf

This value packed planning tool includes:

- Average Tax Savings >$35k/year

- Includes documentation and legal citations for over 130 strategies

- Illustrate tax scenarios and your ideas for savings opportunities

- Business entity analyzer

- Custom PowerPoint, comparative reports, implementation guides and letters all at the push of a button

- Automatically import tax data through uploading a pdf of most recent tax return

- Excellent substantiation for premium fee engagements

Software Comparison