By Jason Ackerman, CPA, CFP®, CGMA and Co-Founder of Wealth Rabbit

Taxes can feel overwhelming, especially for small business owners—but they don’t have to be. Whether you’re running a small business, freelancing, or managing an LLC, understanding and using the right tax deductions can make a big impact on how much you owe.

By knowing what qualifies as a deductible expense, keeping accurate records, and staying informed about available deductions, you can maximize your tax savings and keep more of your hard-earned income.

Why Deductions Matter

Every dollar you deduct from your business income reduces how much you pay in taxes. Most everyday business expenses are deductible—as long as they serve a clear purpose for your business. Let’s break down the main areas where you can save.

Employee Expenses You Can Deduct

If you have employees, many of the costs to support them are deductible. These may include:

- Health, life, and disability insurance premiums

- Employee discounts

- Education and training assistance

- Business-related gym or club memberships

- Company car expenses

- Dependent care assistance

Tip: These expenses must be directly related to your business. Keep documentation just in case the IRS asks for proof.

Operations & Equipment Deductions

Everyday costs of running your business can add up—and many are deductible, including:

- Supplies & raw materials: Things used to create your product or service

- Repairs & maintenance: For equipment or office space

- Software & subscriptions: Tools like QuickBooks, Canva, Adobe, or Asana

- Licenses & permits: Required to legally run your business

- Rent for business space: Office, storefront, or co-working space

- Business use of personal property: If you use your car or home for business, you may be able to deduct part of those costs

Tip: Save receipts and track your spending. It’s much easier at tax time.

Startup Cost Deduction

Starting a new business? You may be able to deduct up to $5,000 in startup costs in your first year. This includes:

- Legal or accounting fees

- Market research

- Employee training

- Advertising and promotional costs before launch

If your total startup costs are over $50,000, your deduction will be reduced. Over $55,000, you won’t be eligible for this deduction (IRS Publication 535).

Retirement Plan Contributions

Setting up a retirement plan can benefit both you and your team—and those contributions are often tax-deductible.

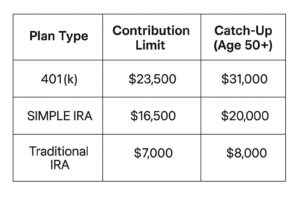

Here are the 2025 limits:

Employer contributions are also deductible—making it a win-win for saving and reducing taxes.

Final Thoughts

Understanding your tax options is one of the smartest things you can do for your business. By using available deductions, taking advantage of startup cost rules, and contributing to retirement plans, you can protect your bottom line and plan for long-term success.

Tip: Always check with a qualified tax professional to make sure you’re maximizing your savings and staying compliant.