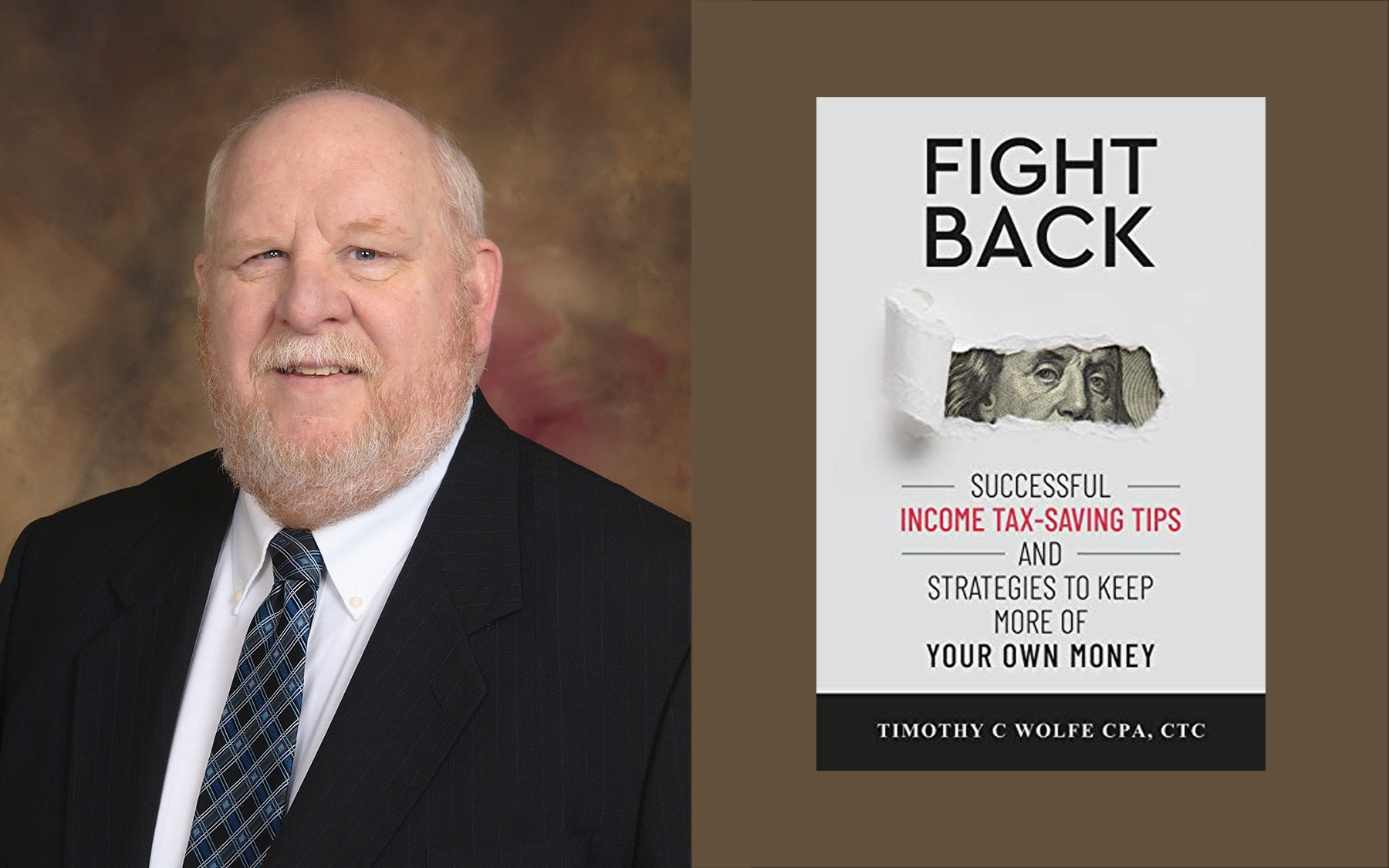

For Timothy C. Wolfe, 2019 was a year of major accomplishments. He completed his intensive training to become a Certified Tax Coach and then went on to write and publish his first book, Fight Back: Successful Income Tax-saving Tips and Strategies to Keep More of Your Own Money. “I’ve been in the business for many years, and I only recently fully began to realize that practically everybody overpays their taxes,” shared Tim, “and something needs to be done.” Tim’s business focuses primarily on serving individuals, so his book is directed toward helping individuals and sole proprietors to maximize their tax-saving opportunities throughout different times in their lives.

How is a busy professional able to run his business and also write a book? Tim managed his time by working a little bit every day. He used dictation apps to allow him to talk through his book rather than sitting and typing. He also took part in a program called Self-Publishing School, which provided him with a roadmap and guidance. “They have a program to lead you through the process from putting together and organizing your ideas, getting on a schedule of writing, things to do and things to avoid, making sure you have consistency, then editing and proofreading the book,” Tim shared. With dedication and focus, the whole process took him only about four months to complete.

Mr. Wolfe is approaching the time many consider retiring. Instead, he is looking forward to cutting back his work hours to give him more time to follow his faith-based goals and work with his church and community. Along with his book, he is also considering speaking opportunities to help share his knowledge with those who can benefit from it. And he has recently submitted the manuscript to his second book to the publisher. This one, titled Fight Back: Successful Tax-Saving Tips and Strategies to Keep More Money in Your Business, will focus on small business owners.

One thing Tim learned from becoming a Certified Tax Coach was the idea of leveraging your time and experience. Sometimes paying others for their expertise can save you time and money in the long run that allows you to profit more as a result. “We all only have twenty-four hours, so if you can use someone to leverage your time, you can get more things done.” He found getting professional advice and services made his work easier.

The idea of leveraging relates directly to tax planning. “The opportunity to reduce income taxes by much more than it would cost you to do it yourself, is well worth it.” The irony is not lost on Tim that this year, more than at any other time, he has come to appreciate the value of others’ expertise. Tim chuckles when thinking about his book, acknowledging, “the book is a self-help book, so you really can’t say too much about having Tim Wolfe or some professional help you with these things. But in reality, I could tell you how to pull a tooth even though I am not a dentist, but that’s not necessarily something that would work out very well for you.”

Tim Wolfe values the opportunities he has in life to help other people. “How can you find those people who really want to do something? I’m coming to this point in my life where I’m recognizing a lot of people need a lot of help. Our job is to figure out how to bring those people in so we can work together.”