Today’s large businesses are often comprised of many different companies such as subsidiaries in various locations. If some employees work for more than one of those related companies, and if the companies have their own payrolls, both the business and the affected employees may be overpaying FICA (social security) and FUTA (federal unemployment) taxes. Fortunately, the federal government provides a solution. Multi-entity corporations may avoid overpaying payroll taxes and duplicating payroll efforts by using a “common paymaster.”

Today’s large businesses are often comprised of many different companies such as subsidiaries in various locations. If some employees work for more than one of those related companies, and if the companies have their own payrolls, both the business and the affected employees may be overpaying FICA (social security) and FUTA (federal unemployment) taxes. Fortunately, the federal government provides a solution. Multi-entity corporations may avoid overpaying payroll taxes and duplicating payroll efforts by using a “common paymaster.”

Why Multi-Entity Corporations Sometimes Overpay

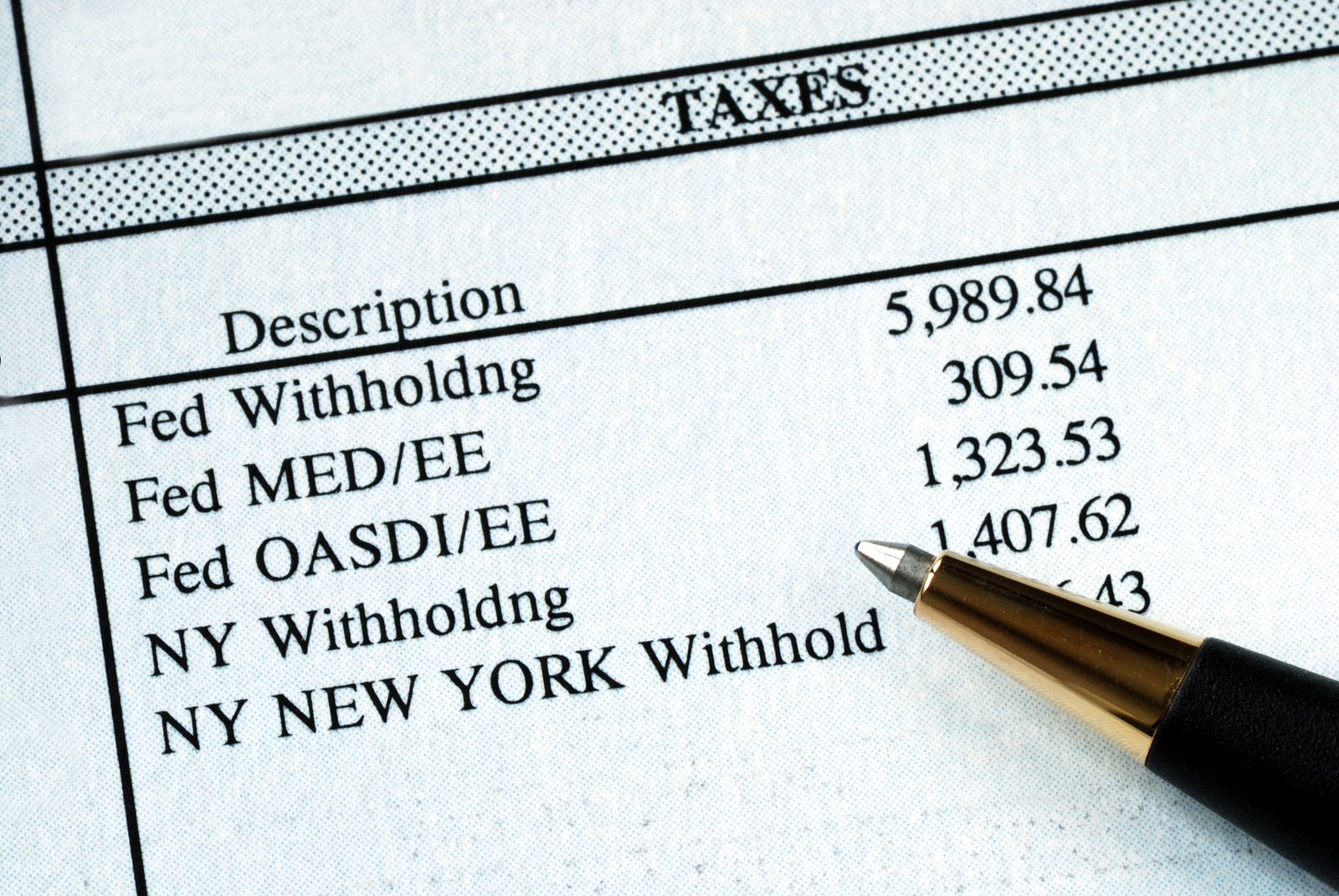

There is a wage cap on social security taxes, and it usually increases every year. The official wage base begins at zero for each company where a person works. If an employee works for various entities of one business and those entities do not use a common paymaster, the amount of payroll taxes the business pays as a whole on that employee can exceed the wage cap. Usually only the social security taxes of relatively highly paid employees are affected, because the total compensation of many employees falls below the annual social security wage cap. The wage cap for FUTA taxes is lower, so it’s more likely a company may pay excessive FUTA tax for an employee than social security tax.

Should employees find they have overpaid into social security of FUTA, they can request a refund. However, employers are not so lucky. Once the IRS has a company’s payroll tax dollars, it will not return them.

How a Company Can Ensure Paying Only Its Fair Share by Using a Common Paymaster

The easy answer to the problem of overpaying for floating employees is to appoint one of your corporate entities as a common paymaster for all employees who work for more than one of the business’s related companies. This enables the business to pay payroll taxes as though the employee only worked for only one employer, so the employee’s wage base is cumulative and does not start at 0 for each company.

The designated common paymaster not only pays employees that work for related companies but is also responsible for keeping their records and submitting payroll taxes. The common paymaster may pay with one check for the work each employee does for all related companies or pay with multiple checks from each entity where the employee works. Each related company is jointly and severally liable for their share of payroll taxes submitted by the common paymaster.

Eligibility for Using a Common Paymaster

26 U.S. Code § 3121(s) and 26 U.S. Code §3306(p) enable a related corporation to be designated as a common paymaster that is treated as a single employer for purposes of the FICA and FUTA wage bases as long as

- The employee works concurrently for the related companies and

- The common paymaster pays the employees both for itself and the other related company where the employee concurrently works.

26 CFR 31.3121(s)-1, Concurrent employment by related corporations with common paymaster, defines what is meant by “concurrent”. According to the regulation, “The contemporaneous existence of an employment relationship with each corporation is the decisive factor; if it exists, the fact that a particular employee is on leave or otherwise temporarily inactive is immaterial… (However) An employment relationship is completely nonexistent if all rights and obligations of the employer and employee with respect to employment have terminated, other than those that customarily exist after employment relationships terminate.”

Additional requirements include the following four IRS tests. Companies must meet one of these criteria to be considered related for purposes of the common paymaster rule.

- The entities must be members of a controlled group of corporations (such as parent/subsidiary and other relationships) as defined in IRC Section 1563 or Reg. 31.3121(s)-1(b)(1)(i), OR

- If the business does not issue stock, then

- At least half of the members of one corporation’s board of directors must be on the other corporations’ board of directors, OR

- the holders of at least half of the voting power to choose such governing board members also hold over half of the voting power of the other entity, OR

- At least half the officers of one of the companies are also officers of the other, OR

- At least 30% of the employees of one company are concurrently employed by the other company

If a company has more than one entity, there is a good chance that they are overpaying payroll taxes for some of their employees absent using a common paymaster. For example, an efficiency expert might spend time at each related company knowing they will return. Executives may make decisions for multiple entities if not all of them. Large businesses that do not investigate using a common paymaster may very well be leaving tax dollars on the table.