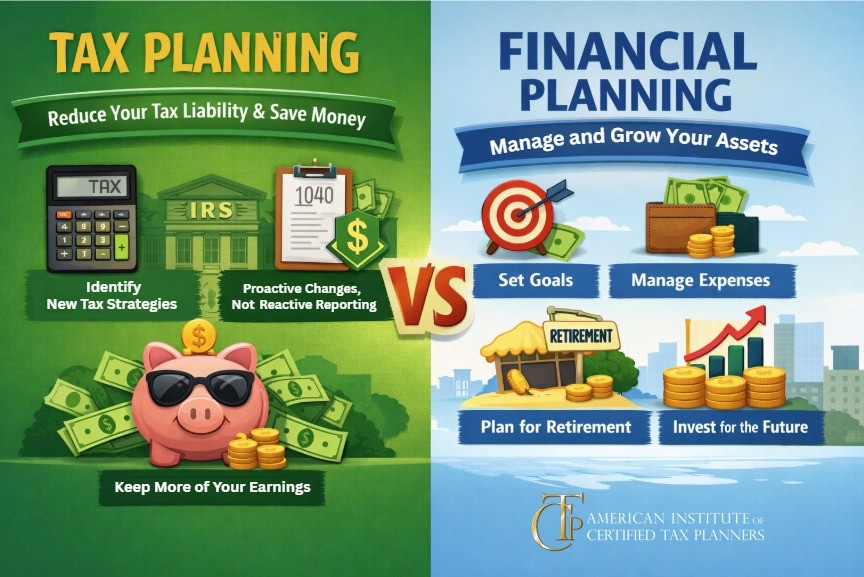

Tax Planning vs. Financial Planning: Why You Need to Understand the Difference

Many business owners assume tax planning is something to think about later – often lumped together with retirement or viewed as a byproduct of financial

Categories

Recent blogs

Tax Savings for Accountants with Gambling Clients

By Loretta Kilday, Spokesperson for Debt Consolidation Care American gaming has boomed since sports betting and online gambling were legalized. Complex tax laws for filing

Redefining Tax Strategy Beyond Retirement Savings: Unveiling the Full Potential of Tax Planning

By Dominique Molina, CPA MST CTS You’re in the business of tax planning, and you pride yourself on being the go-to expert for navigating the

Ethical Issues in Tax Planning: Conflicts of Interest

What does it look like to operate ethically in the world of tax planning? Fortunately, the Office of Professional Responsibility (OPR) provides guidance on key

Ethical Issues in Tax Planning: Unauthorized Practice of Law and Competence

Behaving ethically should be a personal goal for every tax professional—but it is also required by law. To help guide you, the Office of Professional

Amplifying Your Value to Small Business Tax Clients: Answering FAQs about the New Beneficial Ownership Information Requirement

As 2024 kicks off, so do new legal requirements for small businesses. The Corporate Transparency Act took effect on January 1st, which means that many

Amplifying Your Value to Small Business Tax Clients: Advising on the New Beneficial Ownership Information Requirement

In the rush to finish last year strong, small business owners may now find themselves caught off guard by the legal requirements awaiting them in

Tax Breaks for Businesses: Setting Up an IC-DISC

How many of the companies you work with are exporters? Your clients may not readily identify themselves this way, but if any of the products

Tax Breaks for Businesses: Discovering the Benefits of the IC-DISC

If you are working with a company that sells goods made in the U.S. in foreign markets, you may want to introduce this lucrative tax

Qualified Opportunity Funds – A Once in a Generation Tax Incentive to Grow Wealth

Sometimes we don’t recognize a good thing until it is gone. For most, that is turning out to be the case with Qualified Opportunity Funds

Tax Planning for Partnerships: What Are the Requirements for Using Special Tax Allocations?

If you are working with business partnerships or entrepreneurs trying to decide on an entity type, be sure to introduce them to the tax benefits