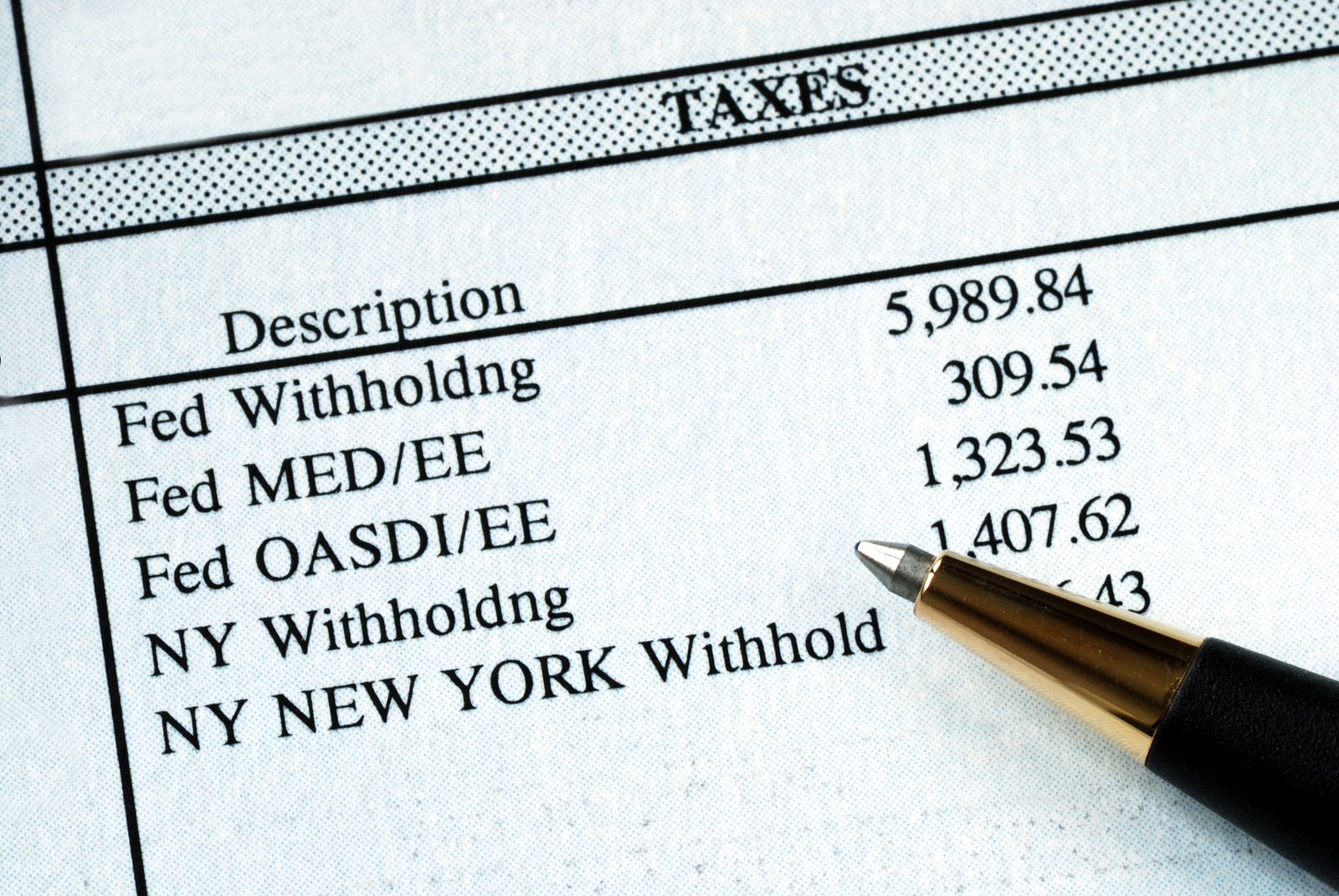

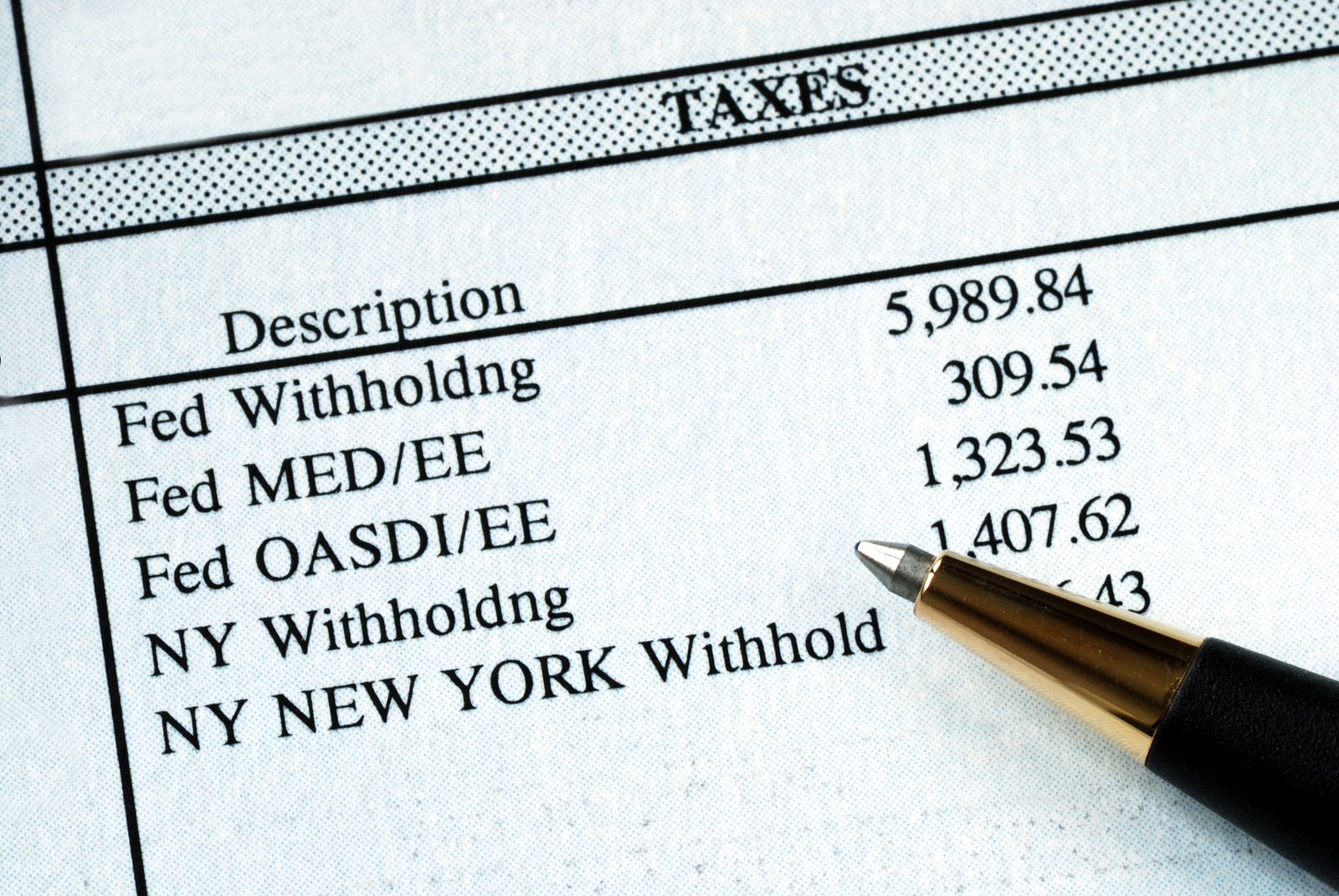

How to Decrease Your Payroll Taxes with a Common Paymaster

Today’s large businesses are often comprised of many different companies such as subsidiaries in various locations. If some employees work

Today’s large businesses are often comprised of many different companies such as subsidiaries in various locations. If some employees work

If your clients are investing for retirement income, it pays to focus on tax savings to get them there quickly.

A timeshare is not only a great opportunity to get away for a while, but it can also be a

If you have more than one home, renting one to a relative may appear at first glance to be a

Upstreaming is a tried and true method of saving on taxes by skillfully moving income from one subsidiary to its

In the runup to the 2017 tax reform package, the State And Local Tax deduction “loophole” fell into the crosshairs.

We don’t always agree and regardless the issue, there are always arguments on both sides, and discussions are often heated.

Some laws are enacted because they appear to provide solutions to issues in need of resolution. That seemed to have

A swelling wave of identity theft attempts against employers has the IRS pretty concerned. So much so, it is offering

Not so fast, taxpayers! Proceed with caution, warns the IRS, after New York and New Jersey approved workarounds involving charitable