Many business owners assume tax planning is something to think about later – often lumped together with retirement or viewed as a byproduct of financial planning. This misconception can be costly. In reality, tax planning is a separate and essential discipline, and when implemented early, it becomes the foundation that allows you to keep more of what you earn and intentionally direct those dollars toward business growth or long-term wealth.

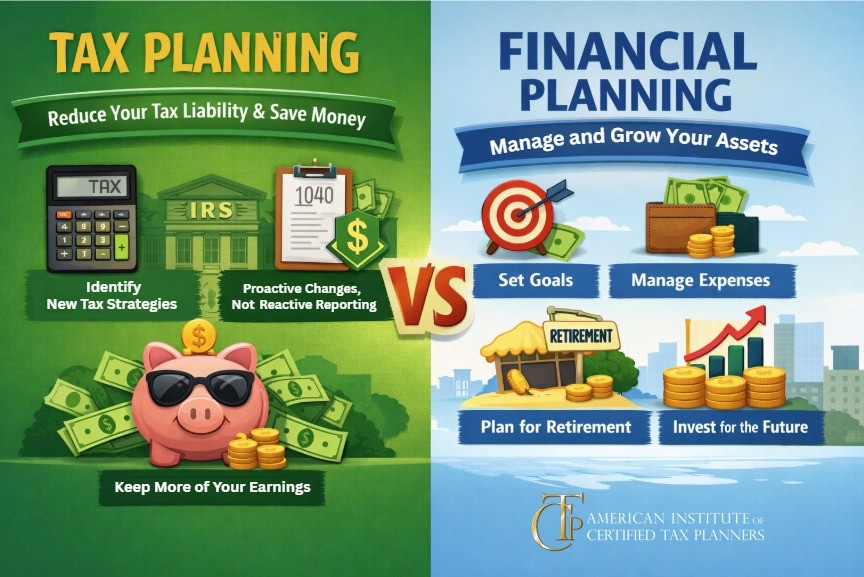

Understanding the distinction between tax planning and financial planning is the first step toward making more informed decisions about your money.

What Tax Planning Really Is – and What It Is Not

The Common Misconception: “Tax Planning Is Just for Retirement”

One of the most persistent misunderstandings among business owners is that tax planning exists primarily to support retirement savings. While retirement strategies can be part of a tax plan, they are not the starting point.

Tax planning early in the life of a business focuses on reducing unnecessary tax leakage – money lost to taxes simply because income and expenses were not structured intentionally. Every dollar preserved through strategic tax planning is a dollar that can be reinvested into hiring, expansion, technology, or future retirement savings.

In other words, tax planning is not the end goal; it is the mechanism that creates capacity. You cannot grow what you do not first keep.

What Financial Planning Covers

Financial planning addresses the broader question of how money is managed and deployed over time to meet personal and business goals. It looks at the full financial picture and emphasizes long-term outcomes.

Financial planning typically includes:

• Setting short- and long-term financial goals

• Budgeting and cash flow management

• Investment strategy and risk management

• Retirement projections and savings targets

• Insurance and protection planning

• Estate and legacy considerations

Taxes are considered within financial planning, but usually as one variable among many. The emphasis is on alignment with goals, not on minimizing tax liability year by year.

Where the Confusion Occurs

The confusion arises because tax planning and financial planning overlap, but they are not interchangeable.

Financial planners may account for tax implications when recommending investments or retirement contributions, but they may not specialize in the detailed, year-by-year tax strategies that materially reduce tax exposure for business owners. Tax planning requires deep, specialized knowledge of tax law, entity structures, compensation strategies, and incentives that change frequently.

Assuming taxes are “handled” simply because you have a financial plan can result in missed opportunities and higher lifetime tax costs.

Why Tax Planning Must Come First

For business owners, tax planning is foundational. It determines how much capital remains available to execute any financial plan at all. Without intentional tax planning:

• Growth capital may be unnecessarily reduced

• Retirement savings may be constrained

• Cash flow may be misaligned with goals

When tax planning is addressed early and revisited regularly, it creates efficiency. That efficiency fuels both business growth and long-term wealth accumulation.

The Bottom Line

By treating tax planning as a distinct and essential discipline rather than a retirement add-on or a subset of financial planning, business owners position themselves to retain more earnings, make better decisions, and build with intention.

Paying less in taxes is not the goal by itself. It is the means by which you gain control over what you can grow next.

If you’re a CPA, EA, or tax professional who wants to deliver deeper value to clients—and build a more profitable, advisory-driven practice—this is your moment. Business owners don’t need more compliance; they need proactive, strategic tax planning that protects cash flow and fuels growth.

Becoming a Certified Tax Planner equips you with the expertise to lead these conversations confidently, uncover overlooked opportunities, and position yourself as the strategist clients rely on year-round—not just at filing time. Become a Certified Tax Planner today.