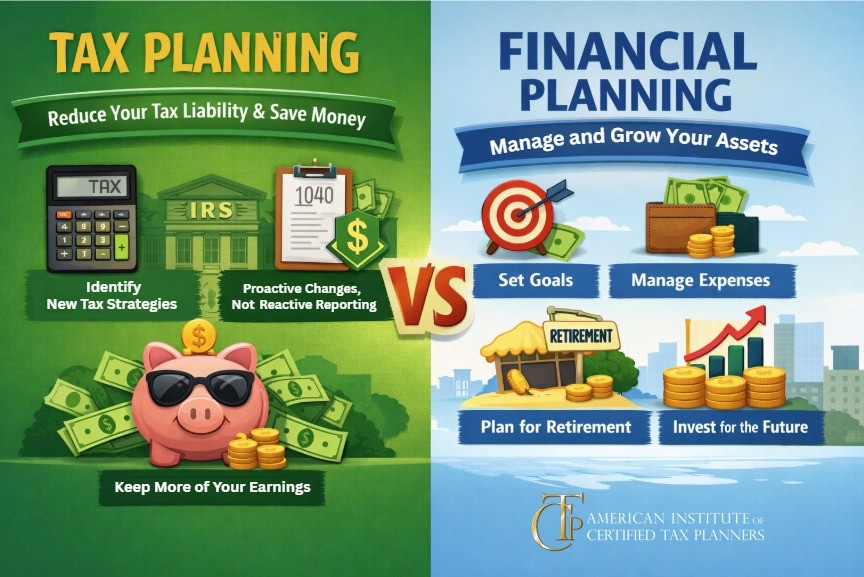

Tax Planning vs. Financial Planning: Why You Need to Understand the Difference

Many business owners assume tax planning is something to think about later – often lumped together with retirement or viewed as a byproduct of financial

Categories

Recent blogs

How Do Accountants Charge Upfront for Their Services?

By Michelle Weinstein, Founder of The Abundant Accountant Have you ever wondered…How do accountants charge upfront for their services when so much of their work

Part 2: Tax Planning for the OBBB: How the New Tax Act Can Benefit Business Owners

A new administration typically means new tax policies, and tax planners have been waiting since the November election to see what would change. Now that

Part 1: Tax Planning for the OBBB: How the New Tax Act Can Benefit Business Owners

After months of waiting, clarity is finally coming. The tax and spending package unofficially known as the “One Big Beautiful Bill” Act (OBBB) has been

Salary vs Distribution: How Should You Pay Yourself?

By Paul Hamann, Founder & President, RC Reports If you own and work within your S-Corp, you’re often faced with some serious decisions. One of the greatest

The Tax Advantages Most Small Business Owners Miss

By Jason Ackerman, CPA, CFP®, CGMA and Co-Founder of Wealth Rabbit Taxes can feel overwhelming, especially for small business owners—but they don’t have to be. Whether

Part 4: Tax Planning for Real Estate Investors: Applying the “Carried Interest” Strategy to Partnerships

Budding real estate investors may not realize that their tax bill could be dramatically impacted by their decision on how to hold their properties. Whether

Part 3: Tax Planning for Real Estate Investors: Understanding Depreciation and Recapture

When working with clients on real estate investments, you will need to prepare them for a higher level of tax complexity. This might mean encouraging

Part 2: Tax Planning for Real Estate Investors: When to recommend a REIT

Working with clients who are getting into real estate investing can be an optimal situation for you both. These clients need a seasoned tax professional

Part 1: Tax Planning for Real Estate Investors: Choosing the Right Structure

For tax planners, taxpayers venturing into the world of investment can make great clients. Investing can be lucrative but also introduces new complexities to your

5 Reasons To Avoid An Earnout When Selling Your Accounting Practice

By Brannon Poe, Founder of Poe Group AdvisorsA version of this article first appeared in The Journal of Accountancy’s CPA Insider™ By Brannon Poe, CPA