Tax Advantages of IRS Form 3115 – Request to Change…

What is Form 3115? According to the IRS, the form is filed “to request a change in either an overall

What is Form 3115? According to the IRS, the form is filed “to request a change in either an overall

Is there a cap on how much an employer can provide to an employee as a qualified disaster payment? No,

What is a Qualified Disaster Payment? During these challenging times, laws have been passed to create relief for businesses and

Did you know? The Tax Cuts and Jobs Act has amended the definition of a small business (Code Section 448).

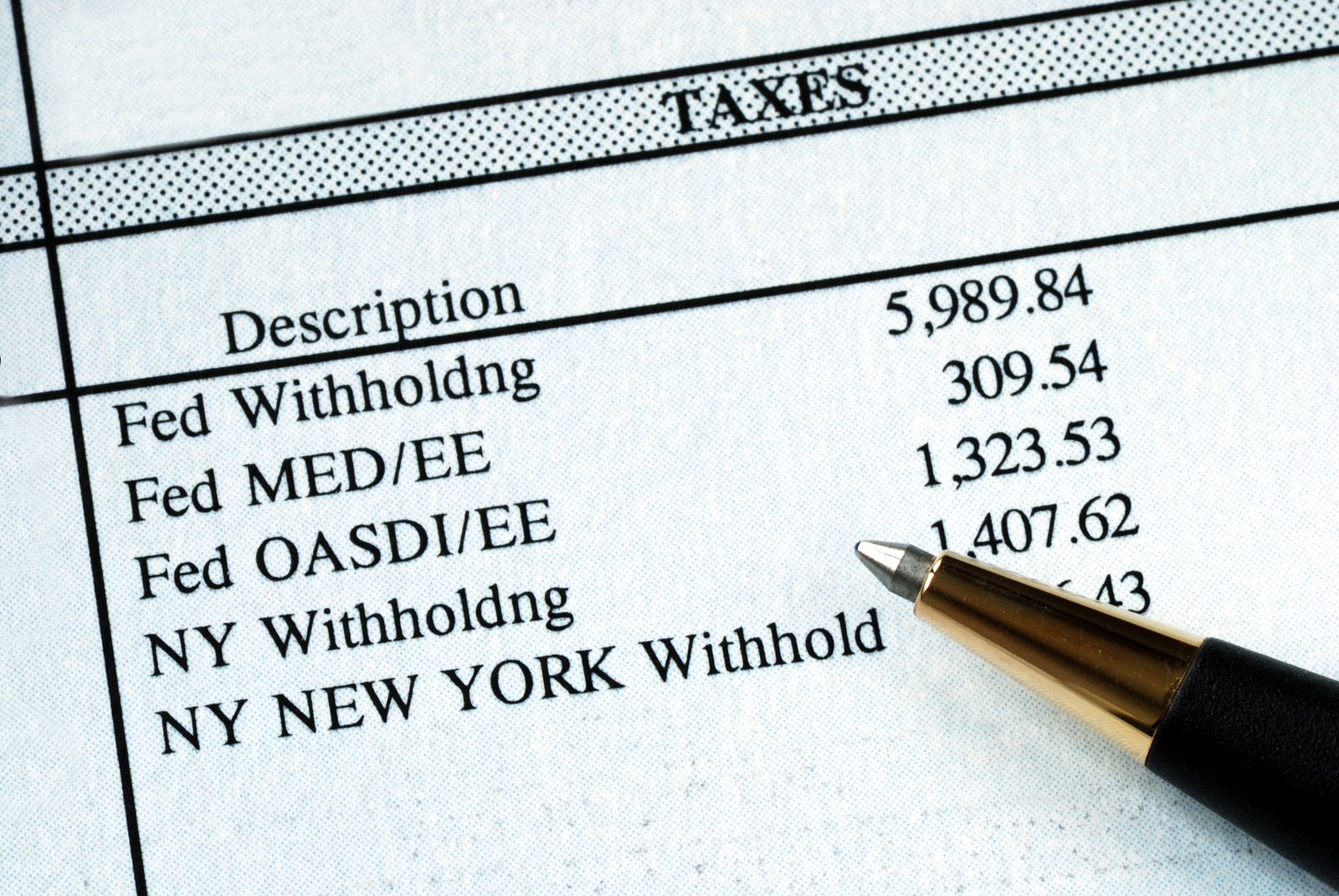

Income taxes are one area where your clients can make a substantial number of mistakes when planning for retirement. Many

Today’s large businesses are often comprised of many different companies such as subsidiaries in various locations. If some employees work

If your clients are investing for retirement income, it pays to focus on tax savings to get them there quickly.

Upstreaming is a tried and true method of saving on taxes by skillfully moving income from one subsidiary to its

In the runup to the 2017 tax reform package, the State And Local Tax deduction “loophole” fell into the crosshairs.

Sole Proprietors and Corporations Have you noticed? Small businesses have been populating the business landscape in clusters? They represent all