Using Value Pricing in Your Tax Practice: Understanding Contingent Fees

As a proactive tax planner, you know that tax planning involves so much more than checking the compliance boxes. A

As a proactive tax planner, you know that tax planning involves so much more than checking the compliance boxes. A

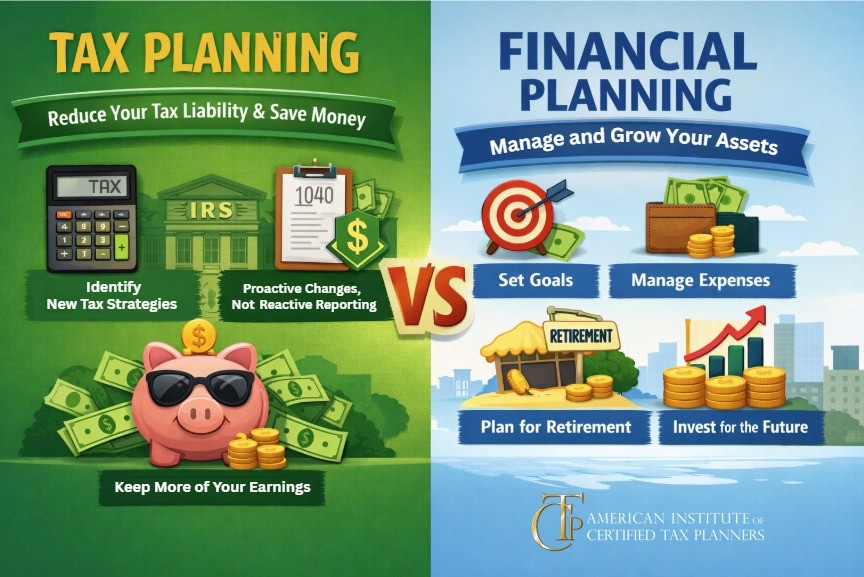

What differentiates a proactive tax planner from a reactive tax planner? A reactive tax planner typically focuses on two things:

Artificial intelligence is having a heyday that is not likely to end anytime soon. The ease with which you can

Tax season is the time of the year most business owners value their CPA the most. And while accurate and

Love it or hate it, artificial intelligence seems to be here to stay. In a profession like tax planning where

When it comes to maximizing your real estate investments, forming a clear tax strategy is a key step. For many

As a tax professional, real investors may come to you looking for ways to mitigate taxes. They may even be

For real estate investors, placing your property into a business entity can serve as a great tax savings strategy. This

Real estate can be a lucrative investment—especially if the owners do advance planning to maximize tax savings. As a tax

Many business owners assume tax planning is something to think about later – often lumped together with retirement or viewed