5 Signs It’s Time to TRADE UP Your CPA for a Certified Tax Planner

Tax season is the time of the year most business owners value their CPA the most. And while accurate and

Tax season is the time of the year most business owners value their CPA the most. And while accurate and

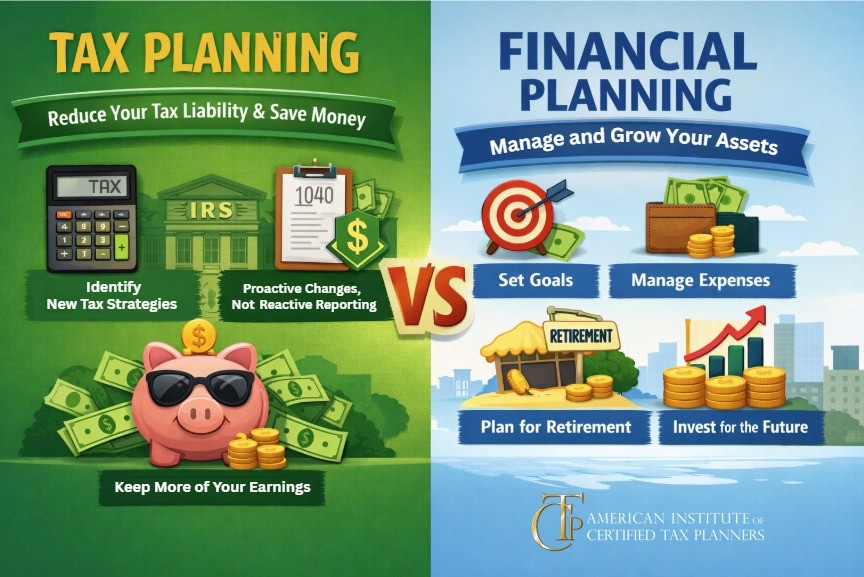

Many business owners assume tax planning is something to think about later – often lumped together with retirement or viewed

When working with clients on real estate investments, you will need to prepare them for a higher level of tax

Working with clients who are getting into real estate investing can be an optimal situation for you both. These clients

For tax planners, taxpayers venturing into the world of investment can make great clients. Investing can be lucrative but also

Why do so many pay more than they have to? Some obvious reasons are mistakes or oversights on their tax

What are my ethical responsibilities when I use software to produce a tax plan? In the world of taxes, there

If you have more than one home, renting one to a relative may appear at first glance to be a

By Dominique Molina, CPA MST CTS Question: How much time should I devote to studying tax planning? Can’t I just

By Dominique Molina, CPA MST CTS Have you asked yourself, do I really have to study tax planning? Can’t I