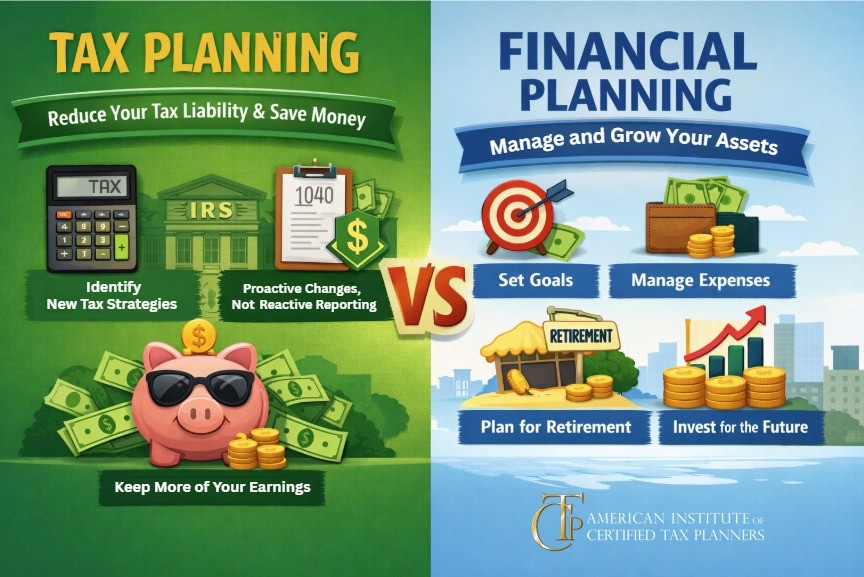

Tax Planning vs. Financial Planning: Why You Need to Understand the Difference

Many business owners assume tax planning is something to think about later – often lumped together with retirement or viewed as a byproduct of financial

Categories

Recent blogs

Part 2: Tax Planning for Real Estate Investors: When to recommend a REIT

Working with clients who are getting into real estate investing can be an optimal situation for you both. These clients need a seasoned tax professional

Part 1: Tax Planning for Real Estate Investors: Choosing the Right Structure

For tax planners, taxpayers venturing into the world of investment can make great clients. Investing can be lucrative but also introduces new complexities to your

5 Reasons To Avoid An Earnout When Selling Your Accounting Practice

By Brannon Poe, Founder of Poe Group AdvisorsA version of this article first appeared in The Journal of Accountancy’s CPA Insider™ By Brannon Poe, CPA

Navigating Tax Reform: The Three Statements that Will Help You Sell Tax Plans This Year

Each new day brings a new headline about upcoming changes to tax law. As Congress weighs major decisions on the renewal of Tax Cuts and

Navigating Tax Reform: Keeping up with Shifting Tax Laws and Tariffs

2025 has been a rollercoaster ride on many fronts, including in the tax world. Today’s news headlines are filled with tariff announcements, proposed tax bills,

Tax Planning for Student Athletes: Working with NIL Collectives

When you think of up-and-coming business opportunities, you likely don’t think of student athletes. As a result of recent court cases, athletes have gained the

Tax Planning for Student Athletes: Entity Selection as a Tax Strategy

In recent years, college athletes at NCAA Division I schools are faced with a new opportunity: turning their burgeoning sports career into a profitable business.

The Inventory Loophole: Using the Cash Method of Accounting Toward Tax Savings, Part 2

The world of small business tax deductions looked very different before and after the Tax Cuts and Jobs Act (TCJA) of 2017. A number of

The Inventory Loophole: Using the Cash Method of Accounting Toward Tax Savings, Part 1

The Tax Cuts and Jobs Act (TCJA) brought about far-reaching changes in the world of tax law. Though recent conversations have fixated on the soon-to-expire

When to Recommend a Partnership Structure: The Tax Benefits of Special Allocations

When it comes to choosing an entity type, many entrepreneurs are drawn to S corporations and may make an election without truly weighing the pros