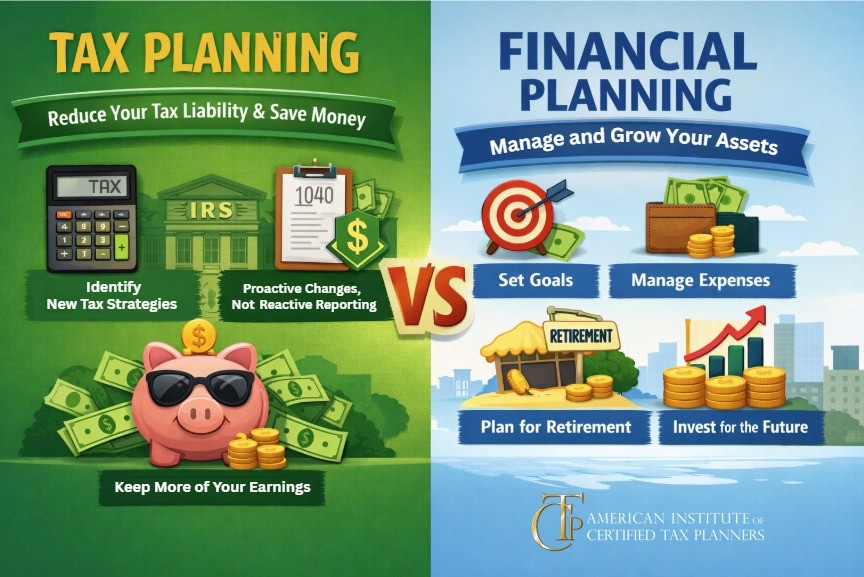

Tax Planning vs. Financial Planning: Why You Need to Understand the Difference

Many business owners assume tax planning is something to think about later – often lumped together with retirement or viewed as a byproduct of financial

Categories

Recent blogs

Should Tax Planners Work with Family Offices? Tax Benefits of Establishing a Family Office

Established, wealthy families have long leveraged the concept of a “family office” to preserve their wealth, ensure business succession, establish governance and control, and foster

Should Tax Planners Work with Family Offices? How Family Offices Work

In recent years, tax planners have increasingly been recruited to work alongside family offices. If you’ve heard about this trend or received an invitation yourself,

The Road to Commercial Property Tax Savings: Understanding the Methods for Property Valuation

As property tax bills continue to rise, property owners are turning to us as tax professionals asking what they can possibly do to lower these

The Road to Commercial Property Tax Savings: Preparing to Appeal an Assessment

Want information on residential property assessment appeals instead? Read here. Working with property owners can be a lucrative investment—both for your client and for you

Tax Planning as a Client Advisory Service

Client Advisory Services (CAS) have emerged as a crucial offering for accounting firms, evolving the traditional client-accountant relationship into a more strategic partnership. Defined by

Helping Homeowners Lower Their Property Tax Bills: How to Appeal an Assessment

Want information on commercial property assessment appeals instead? Read here. This tax season marks the highest property tax rates the nation has seen in five

Helping Homeowners Lower Their Property Tax Bills: Look for Signs of an Over-Assessment

News headlines are making it clear that homeowners across the country are experiencing similar pains—a dramatic rise in their latest property tax bills. The average

Put It All in Writing: Don’t Skip This Tax Planning Best Practice

As a tax planner, you have frequent conversations with clients about possible tax strategies and strive to provide reliable advice in response to their questions.

Securing the Section 179D Tax Deduction for Clients with Energy-Efficient Commercial Buildings

By Marlon Stepp, Director, Energy Incentives, LEED GA, CEM of Tri Merit Despite all the gloom and doom predictions for commercial real estate, two-thirds of the

Tax Implementation Guides: Income Shifting as a Tax Strategy

Any sophisticated tax strategy needs at least one thing to be successful: an implementation plan. While you may have a clear vision in mind for