Using Value Pricing in Your Tax Practice: Understanding Contingent Fees

As a proactive tax planner, you know that tax planning involves so much more than checking the compliance boxes. A

As a proactive tax planner, you know that tax planning involves so much more than checking the compliance boxes. A

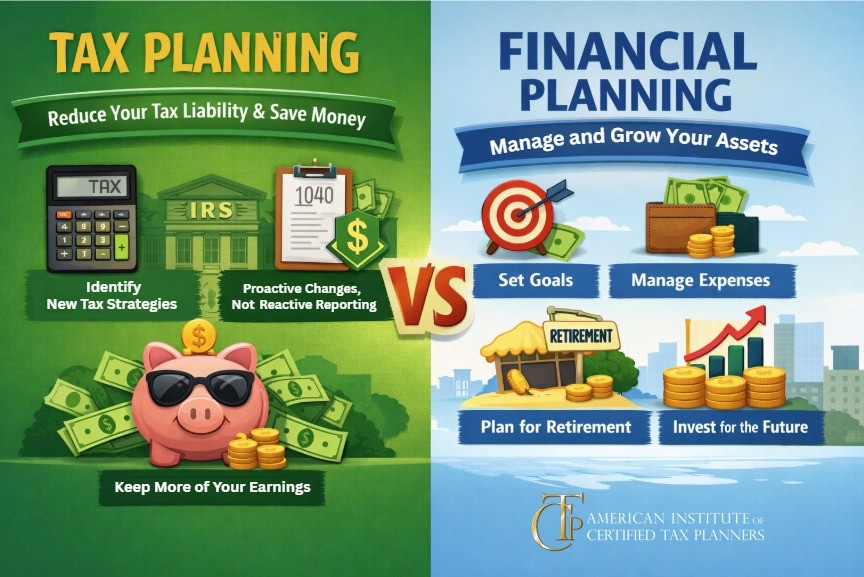

What differentiates a proactive tax planner from a reactive tax planner? A reactive tax planner typically focuses on two things:

Artificial intelligence is having a heyday that is not likely to end anytime soon. The ease with which you can

Love it or hate it, artificial intelligence seems to be here to stay. In a profession like tax planning where

As a tax professional, real investors may come to you looking for ways to mitigate taxes. They may even be

Real estate can be a lucrative investment—especially if the owners do advance planning to maximize tax savings. As a tax

Many business owners assume tax planning is something to think about later – often lumped together with retirement or viewed

Written by Jason Pueschel Alternative Tax Management, LLC As we roll towards another December 31st , with Thanksgiving behind us, stockings hung

“When a client comes to you for help maximizing their retirement savings and minimizing taxes, what is your first move?

“What if traditional retirement savings plans are actually getting in the way of your retirement freedom?” Bold questions like these