Part 4: Tax Planning for Real Estate Investors: Applying the “Carried Interest” Strategy to Partnerships

Budding real estate investors may not realize that their tax bill could be dramatically impacted by their decision on how to hold their properties. Whether

Categories

Recent blogs

The Power of Partnering

I’m often asked about the best thing someone can do to market their tax planning business. If you’ve watched me answer this question before, you’ve

Getting Paid Sooner – Fast Tips For a Smoother Tax Season

Have you ever met this guy before? He’s the one who turns everything in, but won’t return your calls when it’s time to come in,

Fast Tips For a Smoother Tax Season – Managing Expectations

You know the drill, they take until March 14 to FINALLY give you the stuff, and expect everything to be filed the next day. You

A Single Idea to Save Your Clients Thousands This Year

Having just one powerful idea that saves your clients LOTS of money each year can give you the value you need to charge premium fees.

How Much Are You Saving Your Tax Clients Each Year?

Do you know how much you are saving your clients each year on average? Is it close to $33,125 each year? Your clients can take

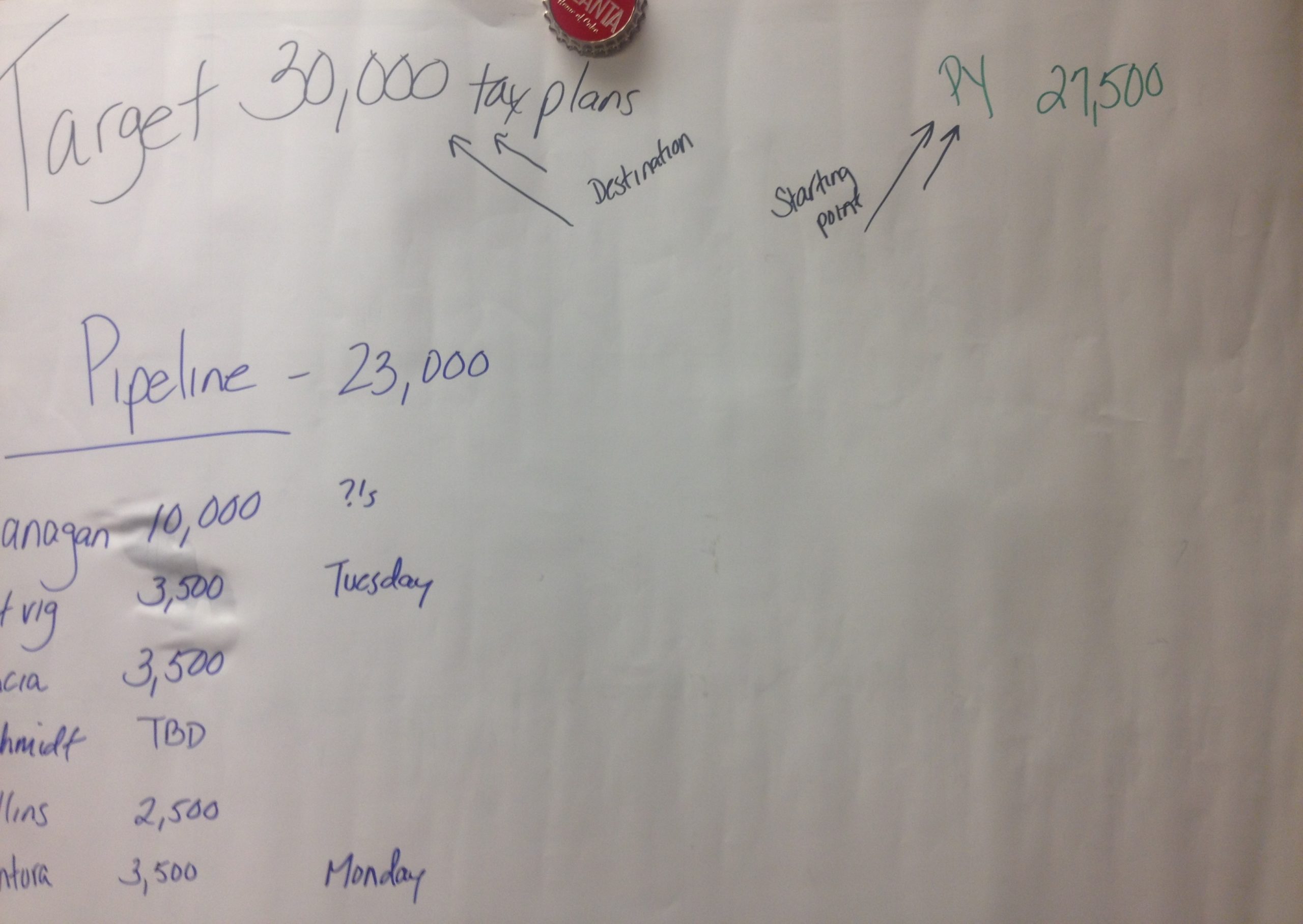

21 Day Challenge Day 2

Getting to a new place in your business is not unlike traveling to a physical location. Having a roadmap makes your trip much easier. Here’s

Social Security Benefit Questions

I want to thank CPA Academy for inviting me to share my knowledge of Social Security benefits with their community. During the webinar the participants brought

How Can You Prevent Clients from Getting Upset When Charging Premium Fees?

Looking to grow your CPA Business? We help tax professionals and financial advisors develop tax planning expertise so they can get paid what they are

Staff Bleeding You Dry??

The problem today is it seems nearly impossible to find and retain qualified, irreplaceable staff to actually HELP you in your business. Since it is

Paperless Office

I must admit, when it comes to a paperless office – I’m the worst offender. There’s something about touching, highlighting, creating dogears, and flipping the