Using Artificial Intelligence in Your Tax Practice: Applying A.I. to Tax Research

Love it or hate it, artificial intelligence seems to be here to stay. In a profession like tax planning where

Love it or hate it, artificial intelligence seems to be here to stay. In a profession like tax planning where

When it comes to maximizing your real estate investments, forming a clear tax strategy is a key step. For many

As a tax professional, real investors may come to you looking for ways to mitigate taxes. They may even be

For real estate investors, placing your property into a business entity can serve as a great tax savings strategy. This

Real estate can be a lucrative investment—especially if the owners do advance planning to maximize tax savings. As a tax

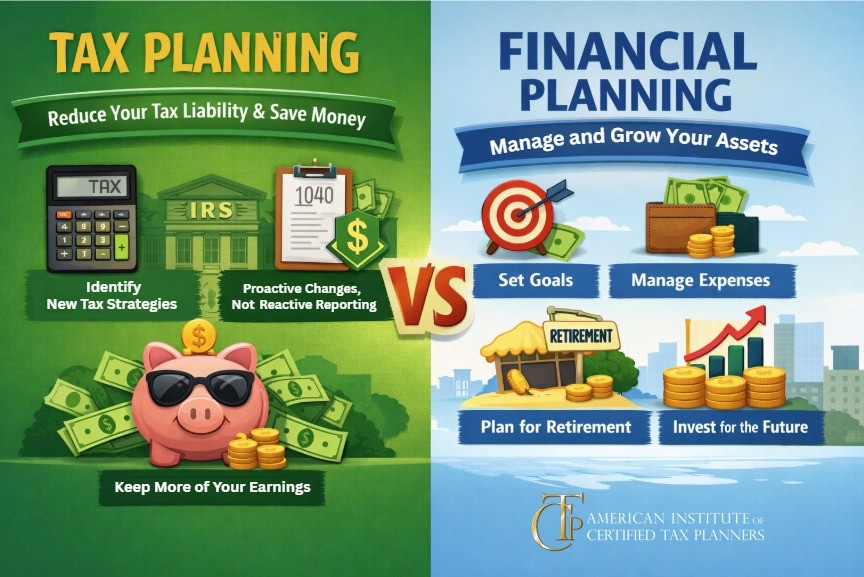

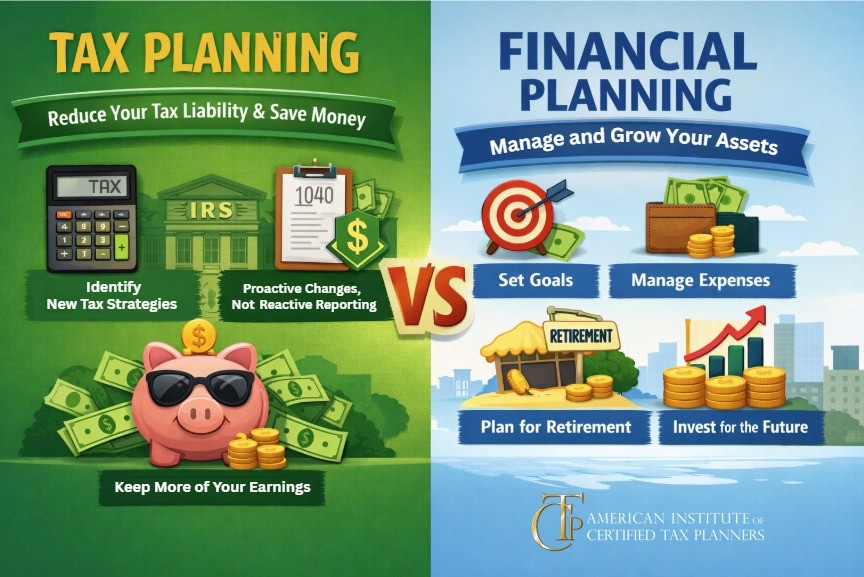

Many business owners assume tax planning is something to think about later – often lumped together with retirement or viewed

Many business owners assume tax planning is something to think about later – often lumped together with retirement or viewed

Written by Jason Pueschel Alternative Tax Management, LLC As we roll towards another December 31st , with Thanksgiving behind us, stockings hung

“When a client comes to you for help maximizing their retirement savings and minimizing taxes, what is your first move?

“What if traditional retirement savings plans are actually getting in the way of your retirement freedom?” Bold questions like these