What Accounting Method Should I Use for My Real Estate Holdings? A Surprising Tax Strategy

When it comes to maximizing your real estate investments, forming a clear tax strategy is a key step. For many

When it comes to maximizing your real estate investments, forming a clear tax strategy is a key step. For many

For real estate investors, placing your property into a business entity can serve as a great tax savings strategy. This

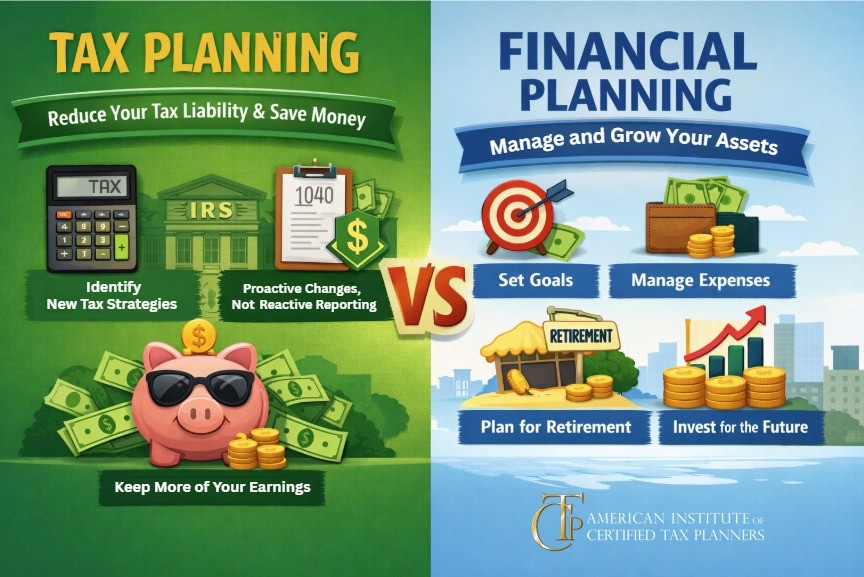

Many business owners assume tax planning is something to think about later – often lumped together with retirement or viewed

Traditional retirement savings plans like 401(k)s and IRAs can go a long way in helping you prepare for retirement. However,

More than half of Americans have a traditional retirement plan like a 401(k) or IRA. For many, these can be

Are all of your retirement “eggs” in one “savings basket”? If you’re part of the 59% of Americans who have a

How does the “One Big Beautiful Bill” Act (OBBBA) impact you? That’s the question on the minds of many taxpayers—and

Now that the dust has begun to settle and Americans are wrapping their minds around the many details of the

It’s official: The new tax package referred to as the “One Big Beautiful Bill” (OBBB) has been signed into law,

With the recent passage of President Trump’s “One Big Beautiful Bill” Act (OBBB), many question marks that have been floating