How to Decrease Your Payroll Taxes with a Common Paymaster

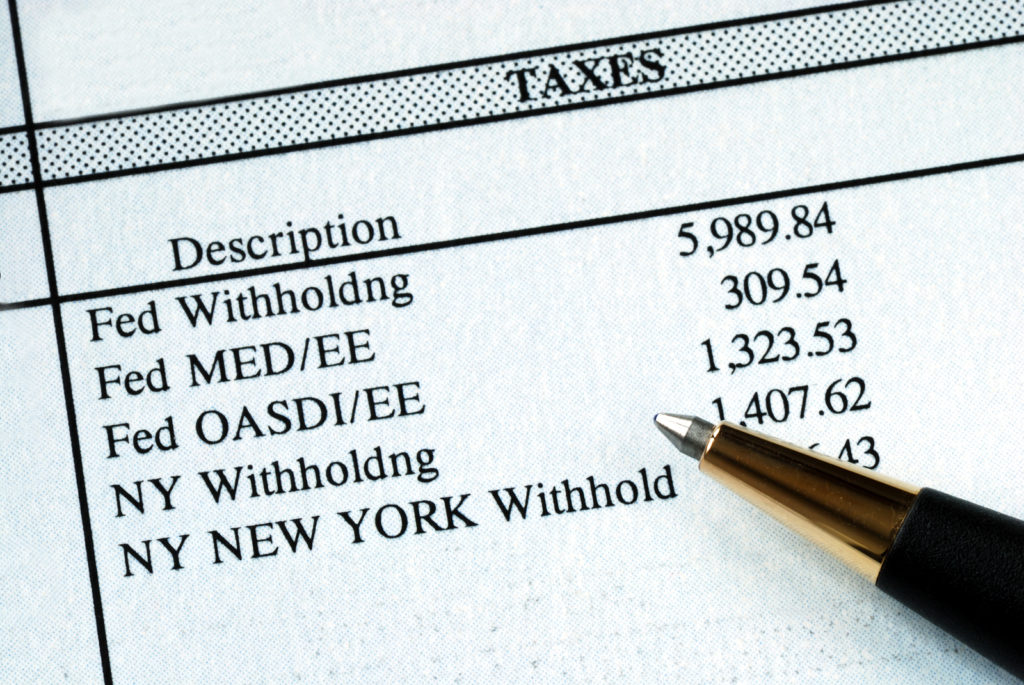

Today’s large businesses are often comprised of many different companies such as subsidiaries in various locations. If some employees work for more than one of those related companies, and if the companies have their own payrolls, both the business and the affected employees may be overpaying FICA (social security) and FUTA (federal unemployment) taxes. Fortunately, […]

How to Decrease Your Payroll Taxes with a Common Paymaster Read More »